Pet Insurance – Home and contents insurance – Wellness plans – Savings – Borrowing – Case studies

Pet insurance

If your fur-baby gets unexpectedly sick or injured, providing treatment can be expensive, not to mention stressful. Pet insurance can help reduce the out of pocket expense for eligible vet bills when things don’t go according to plan.

What does it cover?

Many policies reimburse up to 80% of the eligible vet bills to a value of $10,000 or more each year, meaning if you have an eligible vet bill of $1,000, your policy could cover $800, and you pay the remaining $200 along with any nominated excess (if applicable to the policy) to the vet. Premiums can be paid fortnightly, monthly or annually, with the cost going up each year as your pet gets older and has more health risks and needs.

Pet Insurance is designed to cover pets’ medical expenses should something unexpectedly occur. Unless you opt for a pet insurance policy that includes a non-insurance benefit for routine or preventative care, most policies typically won’t cover every day pet expenses that are easier to budget for, such as flea and tick treatments and vaccinations, as this helps to keep the cost of premiums down.

Pet insurance also generally doesn’t cover pet health issues that already existed before insurance is first taken out (known as pre-existing conditions), or any conditions that develop during the initial policy waiting period/s.

Some conditions can be cured with treatment and don’t require ongoing care however, pre-existing conditions are assessed differently depending on whether they are considered a temporary condition or a chronic condition.

Please refer to our Frequently Asked Questions for more information on pre-existing conditions, or refer to your pet insurance policy’s Product Disclosure Statement (PDS) for more details.

Home and contents insurance – pet cover

Some home and contents insurance policies offer pet care cover, which provides a limited contribution towards pet-care expenses (generally around $500-$2,000 per year).

What does it cover?

These products will typically provide cover for accidental injury to your pet up to a nominated annual or per-condition limit, that’s usually much lower than a stand-alone pet insurance product. There may be many exclusions such as illness, pre-existing conditions, preventative and routine care. Read your Product Disclosure Statement for more information and terms and conditions.

Wellness plan

A wellness plan is a monthly or annual subscription-based service offered by some vets and pets stores to provide a range of preventive pet care services at a discount or free of charge. These might include free vet consultations, discounted pet food, flea and tick treatments, free vaccinations and a small discount on professional vet services.

What does it cover?

Not to be confused with pet insurance, wellness plans are designed more for expected pet care expenses, and typically will only contribute a small percentage towards the cost of diagnostic procedures, hospitalisation and surgery, even though the cost of these services could amount to thousands of dollars.

Pet insurance

Wellness Plan

Savings

A savings plan can be a good addition or alternative to pet insurance and wellness plans, if you already have a large amount saved, are diligent with regular savings payments, and are willing to draw on funds as needed to cover large and unexpected pet costs.

Good to know

However, the challenge lies in the unpredictability of not knowing when your pet might meet with an accident or serious illness, and whether you’ll have saved up enough to cover the cost when it happens.

For example, if you are saving $100 a month and your pet has an accident resulting in a $10,000 vet bill, you’d have to have been saving for just over eight years just to cover that single treatment.

Ongoing treatment can also eat very quickly into savings, which could leave you with large out of pocket expenses to cover.

Borrowing

Borrowing funds via credit or ‘buy now, pay later’ companies can also help to cover pet-care expenses in the short-term, however the related interest rates, charges and other fees can often make them a more expensive option in the long term. Borrowing limits, interest rates and repayment conditions vary from product-to-product, so research is always a good idea to ensure the terms fall within your budget expectations, both now and in the future.

Pet Care in action

Let’s have a look at some specific scenarios to see how Pet Insurance and Wellness Plans compare. Please note that all examples refer to a single incident, so additional benefits provided over the life of the Insurance Policy or Wellness Plan may not be taken into account.

Snake bite case study

Marigold the 5-year-old Golden Retriever was rushed to the vet with a suspected snake bite. Luckily the bite was treated quickly and she received excellent care, so she is on her way to a full recovery.

Veterinary costs – $11,500

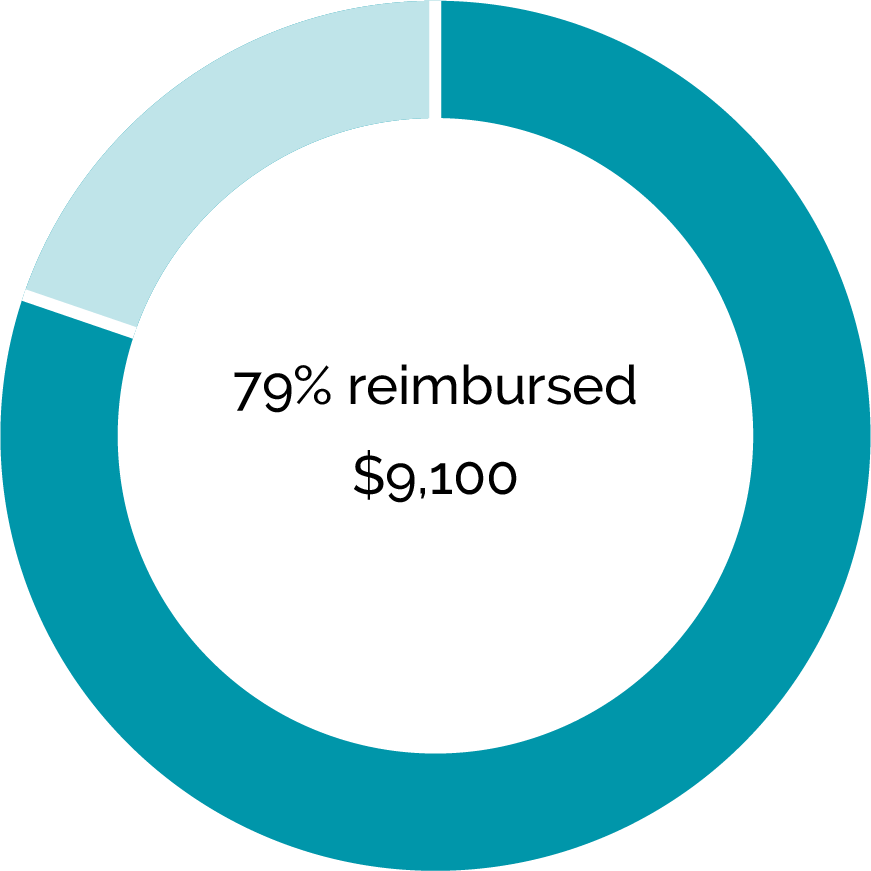

Accident-only pet insurance policy

Based on an Accident-only policy with an 80% Benefit Percentage and a $100 Excess.

80% Benefit Percentage Reimbursement received against veterinary costs minus $100 Excess.

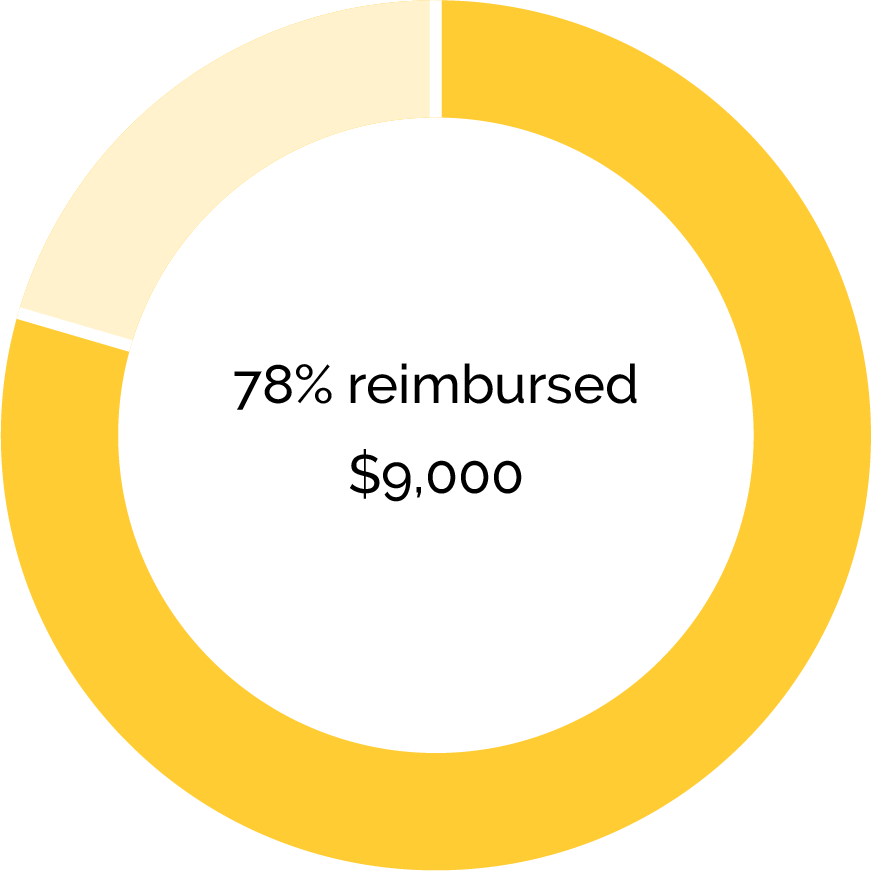

Comprehensive pet insurance policy

Based on a Comprehensive Accident and Illness policy with an 80% Benefit Percentage and a $200 Excess.

80% Benefit Percentage Reimbursement received against veterinary costs minus $200 Excess.

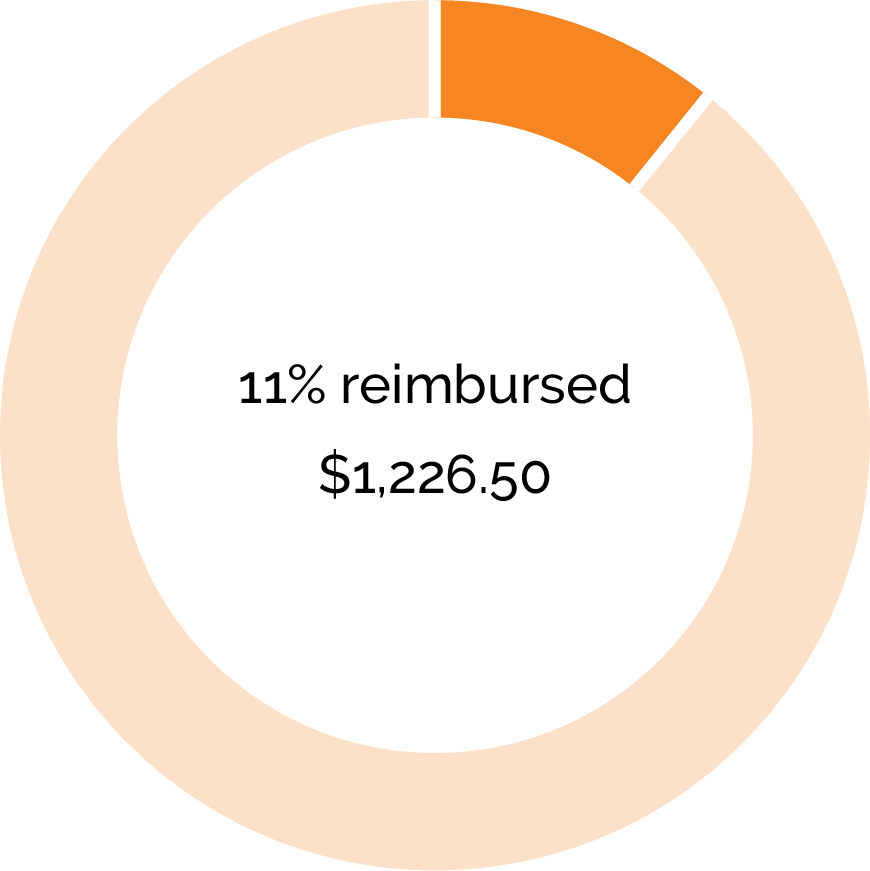

Wellness plan

Based on a wellness plan that includes unlimited veterinary consultations, free vaccinations, and 10% discount towards veterinary services.

Consult fee of $85 and 10% discount towards treatment services received.

# The case study scenarios above are for illustrative purposes only and are not representative of all Pet Insurance policies and Wellness Plans available on the Australian market.

Puppy check-up case study

Jacko the Jack Russell has just had his 16-week puppy check up at the vet, where he received his vaccinations and heartworm medication. As vaccinations and heartworm treatments are generally considered routine and expected treatments, pet insurance policies generally do not cover these conditions unless the pet parent has added an optional extra such as Routine Care on their policy (which provides specified and limited benefits for some routine treatments).

Veterinary costs – $115

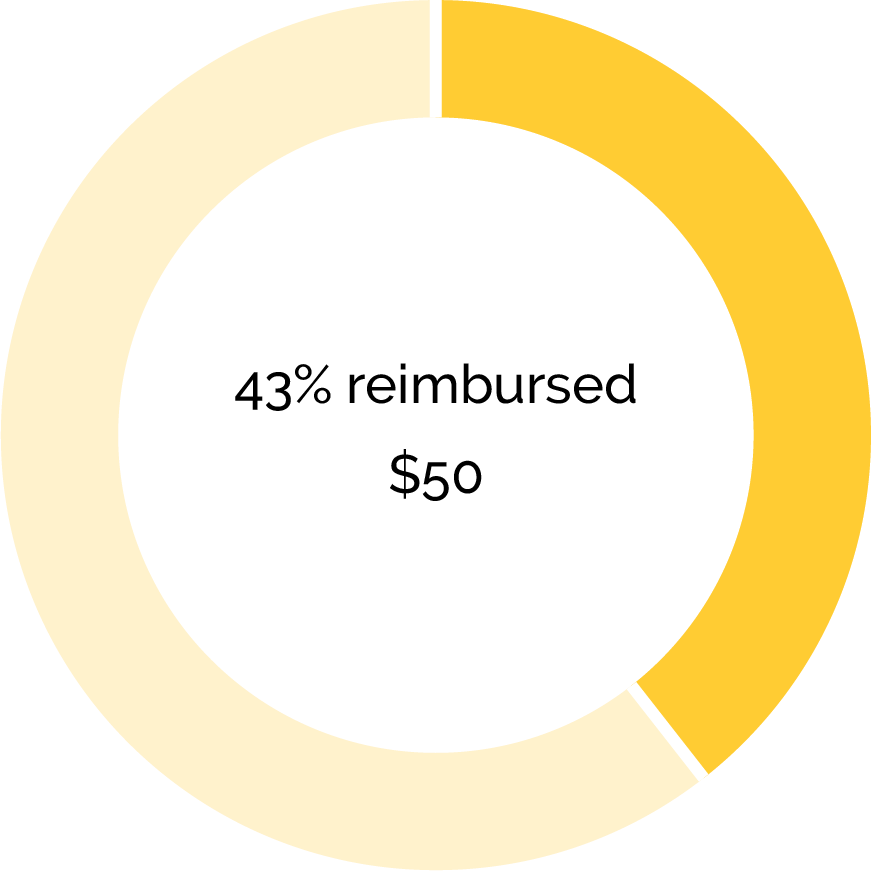

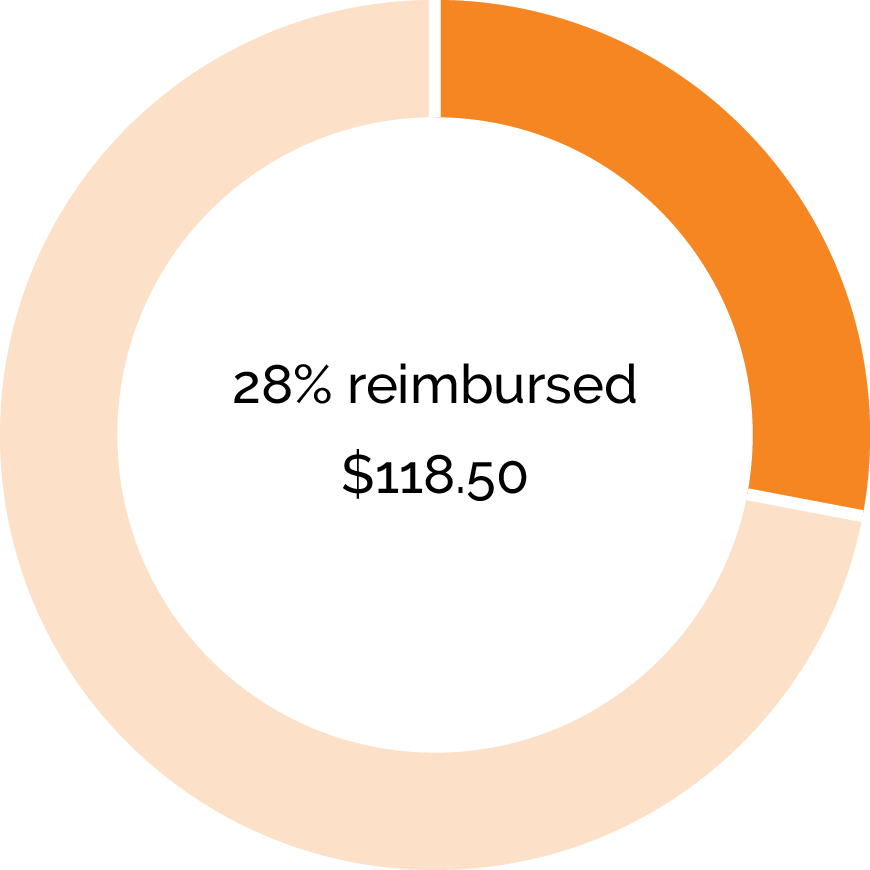

Accident-only pet insurance policy

Based on an Accident-only policy with an 80% Benefit Percentage and a $100 Excess.

No routine care included with this Accident-only policy.

Comprehensive pet insurance policy

Based on a Comprehensive Accident and Illness policy with an 80% Benefit Percentage, a $200 Excess and a $50 Routine Care Benefit.

$50 Routine Care Benefit received.

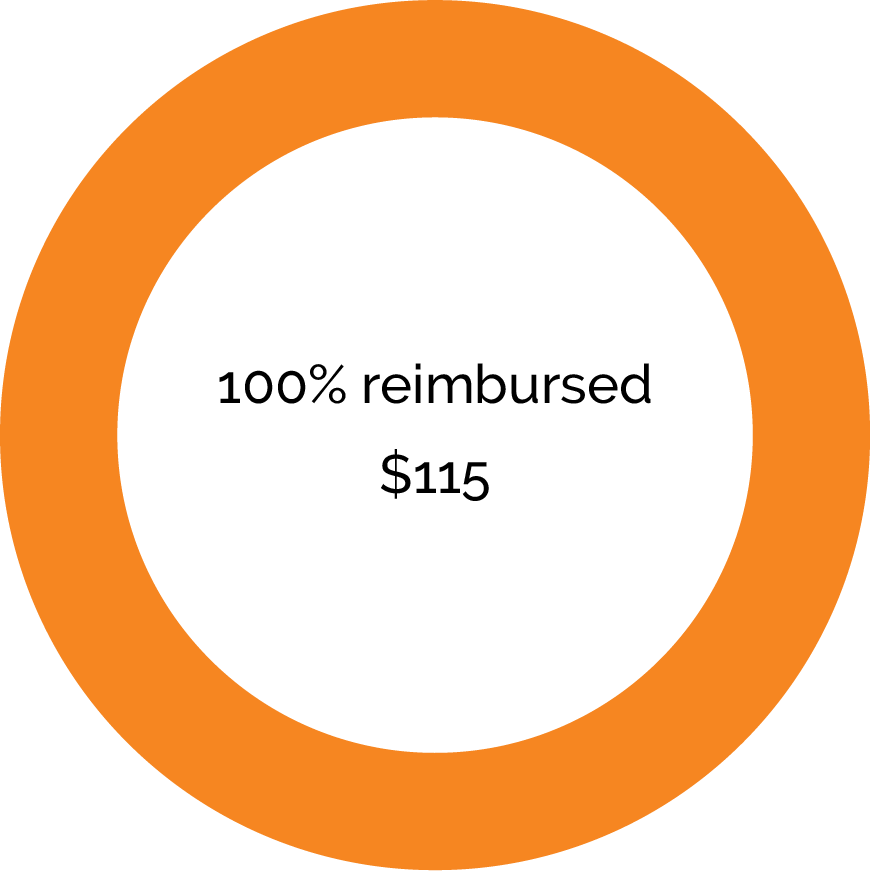

Wellness Plan

Based on a wellness plan that includes unlimited veterinary consultations, free vaccinations, and 10% discount towards veterinary services.

Includes Consultation fee of $85, vaccinations and medication covered under wellness plan.

# The case study scenarios above are for illustrative purposes only and are not representative of all Pet Insurance policies and Wellness Plans available in the Australian market. Please note that Pet Insurance policies may not cover consultation fees and may be subject to limits and additional exclusions.

Skin allergy case study

Fluffy the Maltese-cross goes to the vet as she won’t stop scratching. After a few tests she is diagnosed with Allergic Dermatitis and starts a series of medications.

Veterinary costs – $420

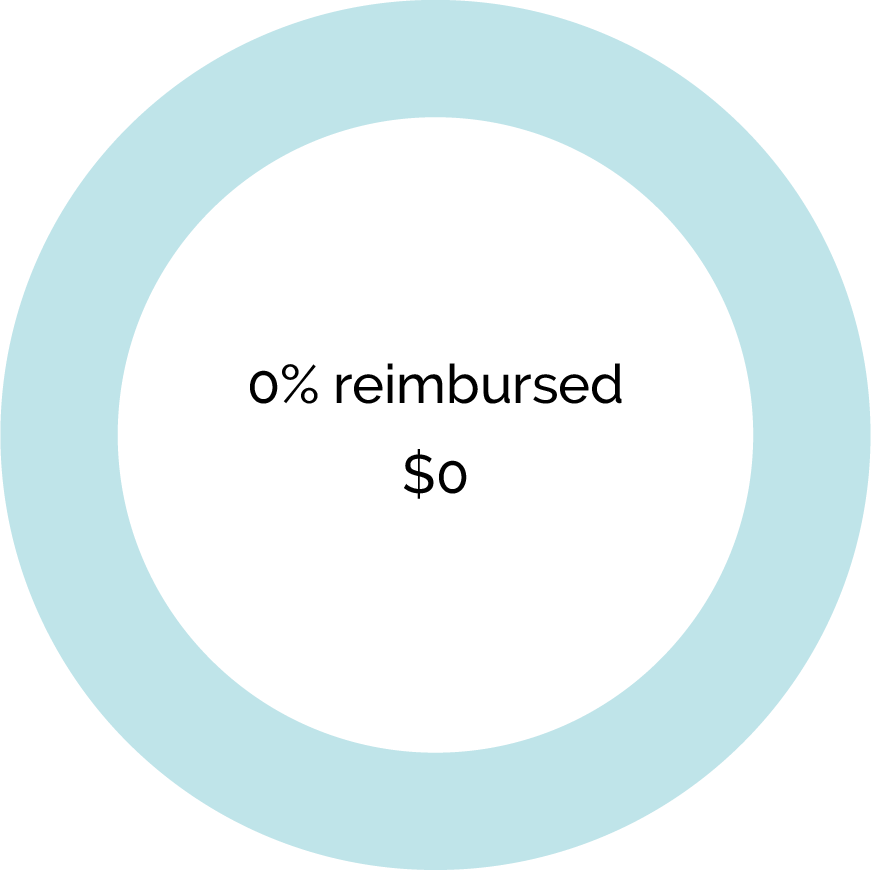

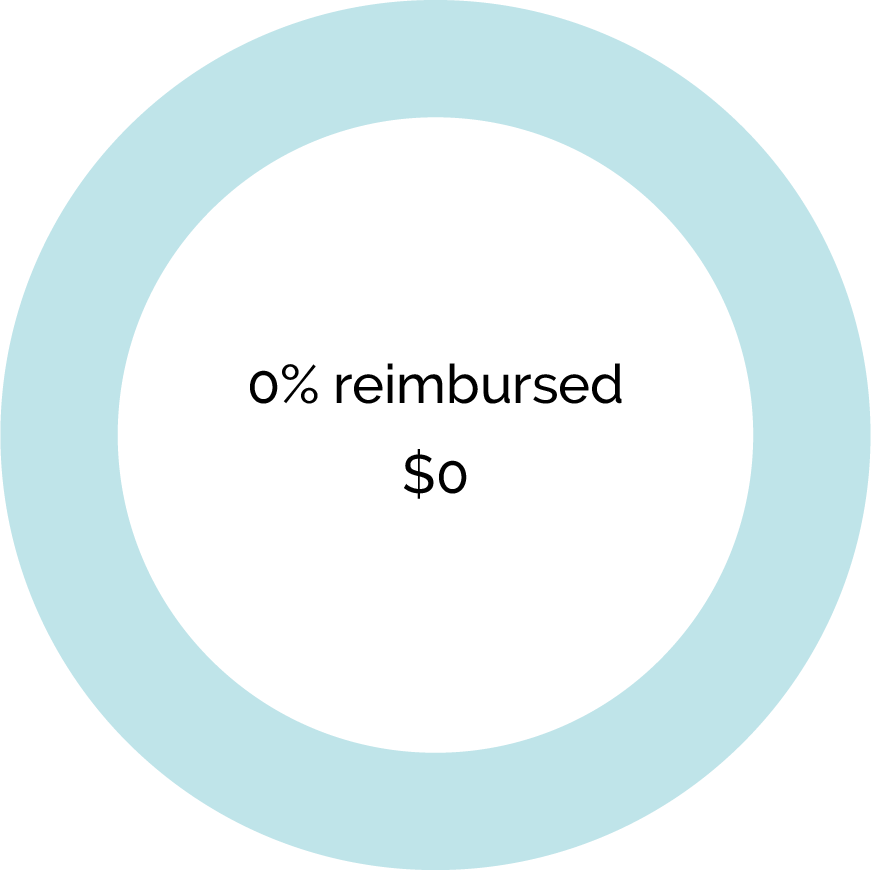

Accident-only pet insurance policy

Based on an Accident-only policy with a $100 Excess.

Accident-only pet insurance policies do not provide cover for illnesses such as allergies.

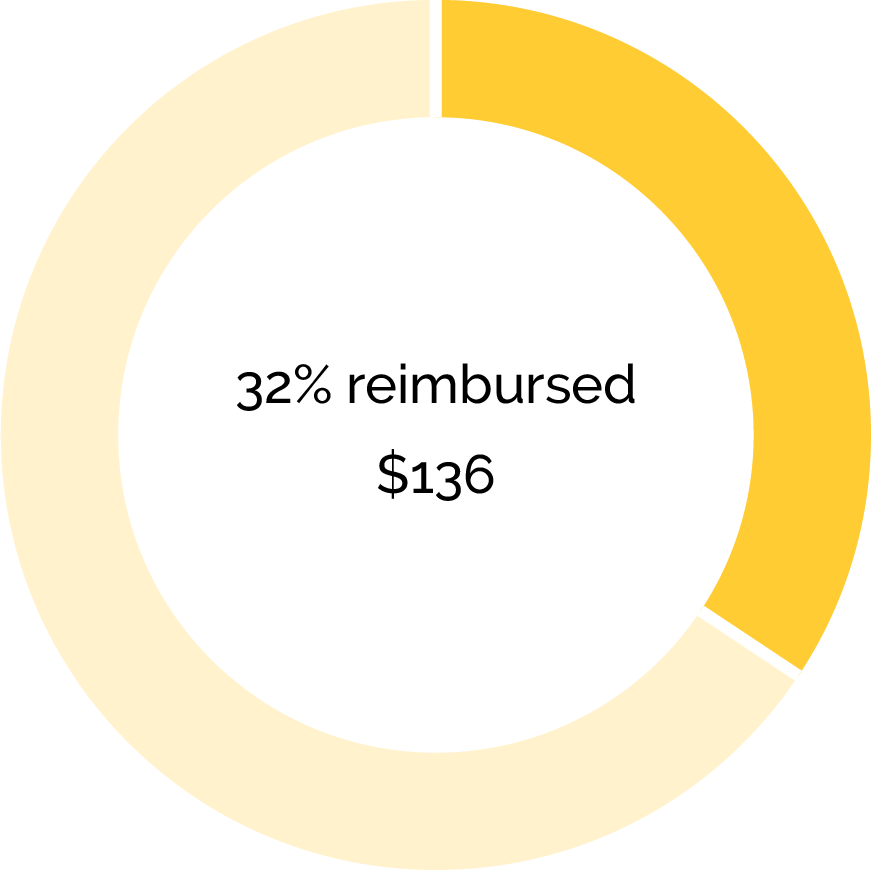

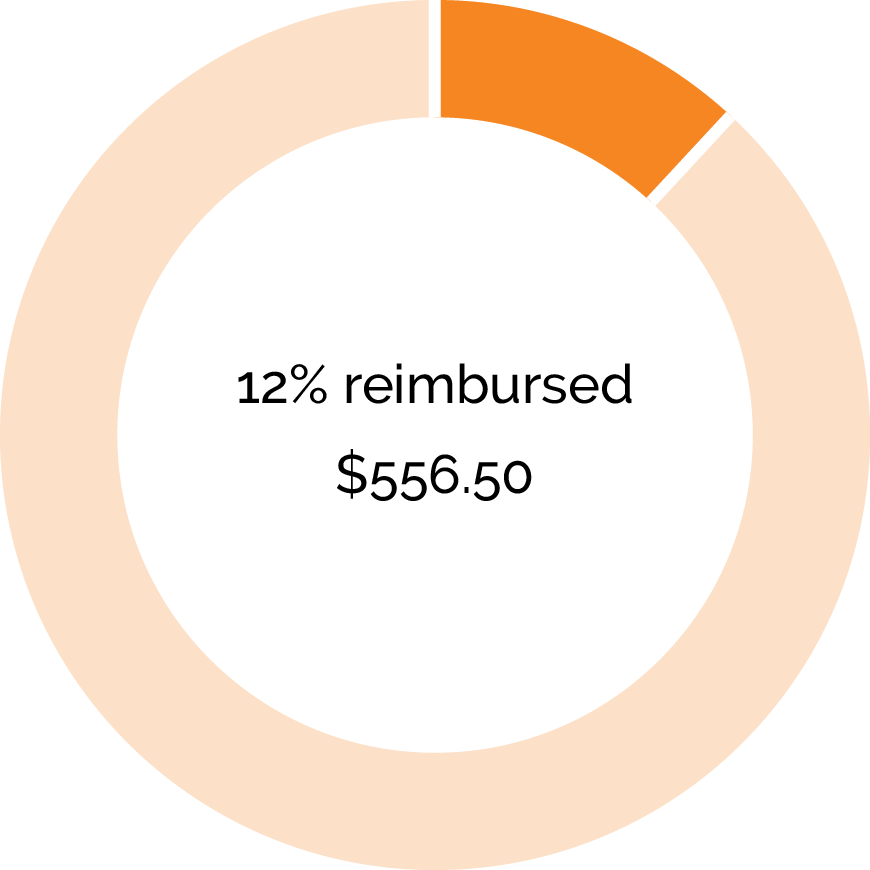

Comprehensive pet insurance policy

Based on a Comprehensive Accident and Illness policy with an 80% Benefit Percentage and a $200 Excess.

80% Benefit Percentage Reimbursement received against veterinary costs minus $200 Excess.

Wellness plan

Based on a wellness plan that includes unlimited veterinary consultations, free vaccinations, and 10% discount towards veterinary services.

Includes Consultation fee of $85 and 10% discount towards services covered under wellness plan.

# The case study scenarios above are for illustrative purposes only and are not representative of all Pet Insurance policies and Wellness Plans available in the Australian market. Please note that Pet Insurance policies may not cover consultation fess and may be subject to excesses, limits and additional exclusions.

Lymphoma (a common cancer) case study

Charlie, a Domestic Short Hair cat is currently undergoing treatment for Lymphoma, a common cancer.

Veterinary costs – $4,800

Accident-only pet insurance policy

Based on an Accident-only policy with a $100 Excess

Accident-only pet insurance policies typically do not provide cover for illnesses such as cancer.

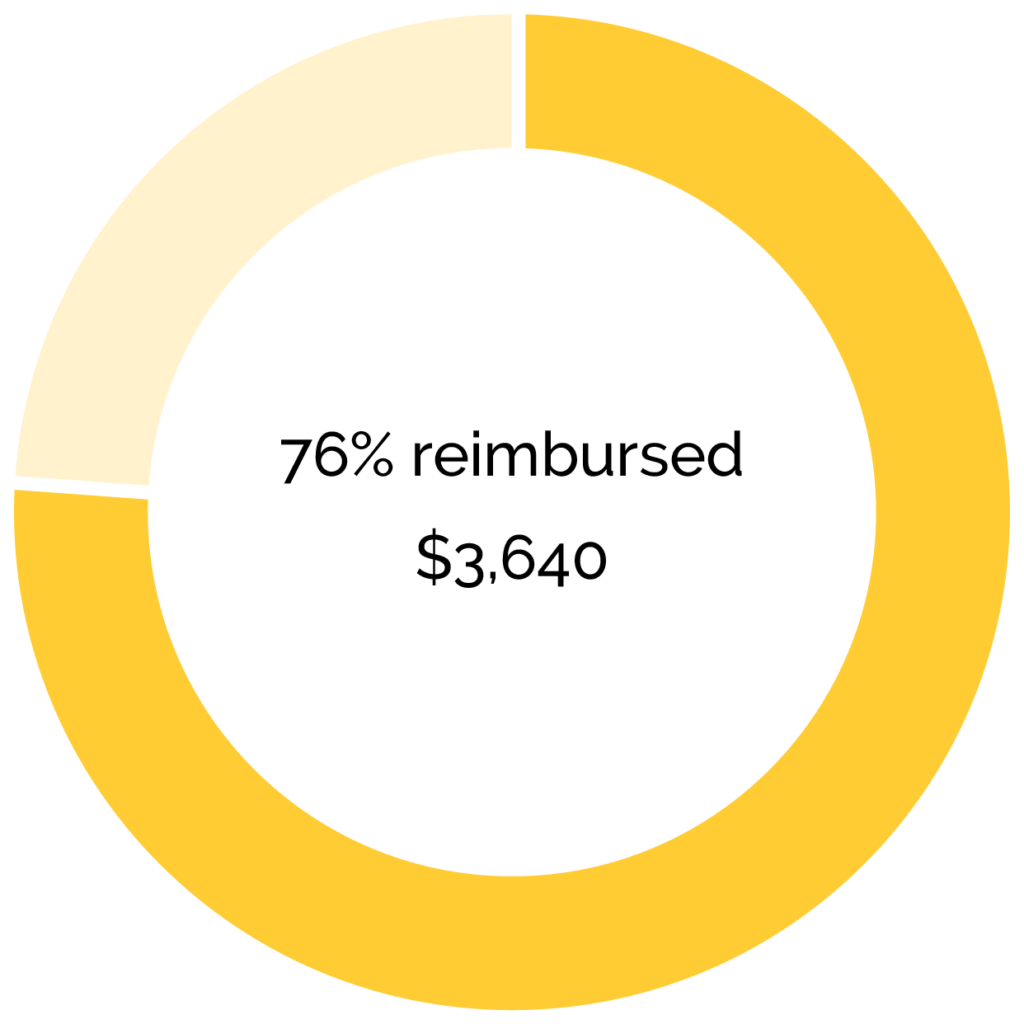

Comprehensive pet insurance policy

Based on a Comprehensive Accident and Illness policy with an 80% Benefit Percentage and a $200 Excess.

80% Benefit Percentage Reimbursement received against veterinary costs minus $200 Excess.

Wellness plan

Based on a wellness plan that includes unlimited veterinary consultations, free vaccinations, and 10% discount towards veterinary services.

Includes Consultation fee of $85 and 10% discount towards services covered under wellness plan.

# The case study scenarios above are for illustrative purposes only and are not representative of all Pet Insurance policies and Wellness Plans available in the Australian market. Please note that Pet Insurance policies may not cover consultation fess and may be subject to limits and additional exclusions.