Many pet parents often ask, “Is a pet insurance policy better than a wellness plan?” but it’s not as clear-cut as some people may think, which is why it’s important to understand your options so you can make an informed decision about your pet’s wellbeing.

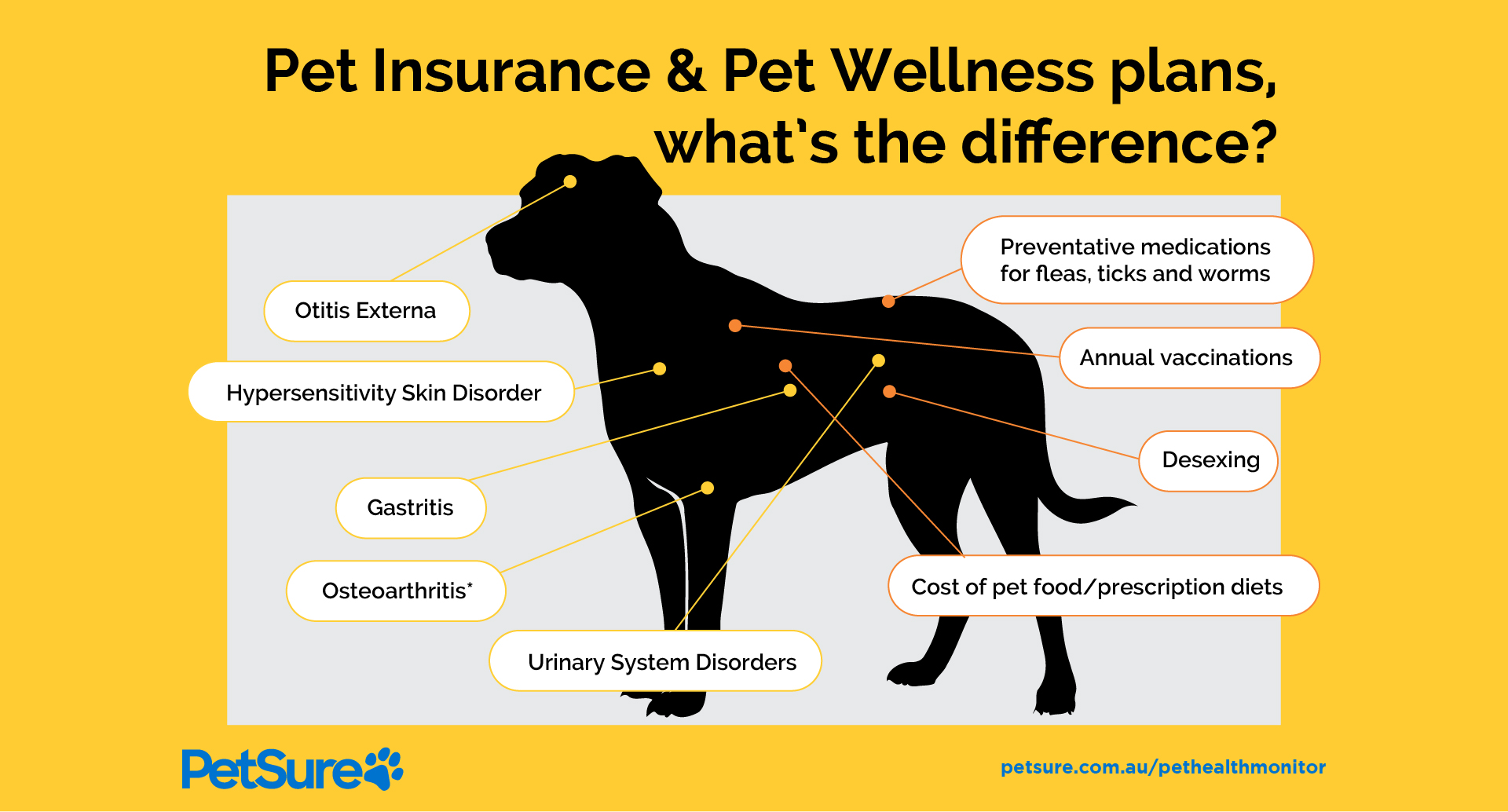

Firstly, it’s important to note that pet insurance and wellness plans are two different products that serve different purposes. Pet insurance helps reduce costs by reimbursing a portion of eligible vet bills for the treatment of unexpected accidents or illness. Depending on the policy and type of coverage, this includes things like cancer, broken bones, treating a snake bite or eating something they shouldn’t – like mum’s pair of socks!

For example, if a dog needed to be treated for a Lymphoma, PetSure data indicates the veterinary cost could be $4,800. If the pet parent had an comprehensive pet insurance policy with an 80% benefit percentage and a $200 excess, the pet parent would be reimbursed 76% or a total of $3,640. However, if the same pet parent took their puppy for a check-up at the vet, they would receive $50 reimbursement under their insurance policy.

A pet wellness plan, on the other hand, can provide a small financial contribution towards expected, regular or preventative healthcare costs. This may include things like annual vaccinations, vet consultations, preventative medications for fleas, ticks or worms or discounted pet care products.

If we take the same Lymphoma case study above with the $4,800 vet bill, a pet parent on a wellness plan (that includes consultations and a 10% discount towards veterinary services) would be reimbursed 12% or a benefit of $556.50. However, in the case of the puppy check up, the pet parent on the wellness plan would be reimbursed the full $115 cost for the consultation.

So whether you’re about to add a companion animal to your family or you’re an existing pet parent, it’s important to weigh up your options and to understand the inclusions and benefits of both pet insurance and wellness plans. While some pet parents may select one option over the other, others may decide to opt for both.

Pet insurance can help by covering a portion of the eligible vet bill if the unexpected happens. Because it is difficult to predict the costs of veterinary care, it can help to have measures in place to help prepare for the unexpected. Check out our partner network and explore our policy tools to find a pet insurance policy.

Not all conditions or items are covered by Pet Insurance. Refer to the applicable Product Disclosure Statement for information about coverage and exclusions.

Fact checked

Fact checked